Subordination Agreement Template

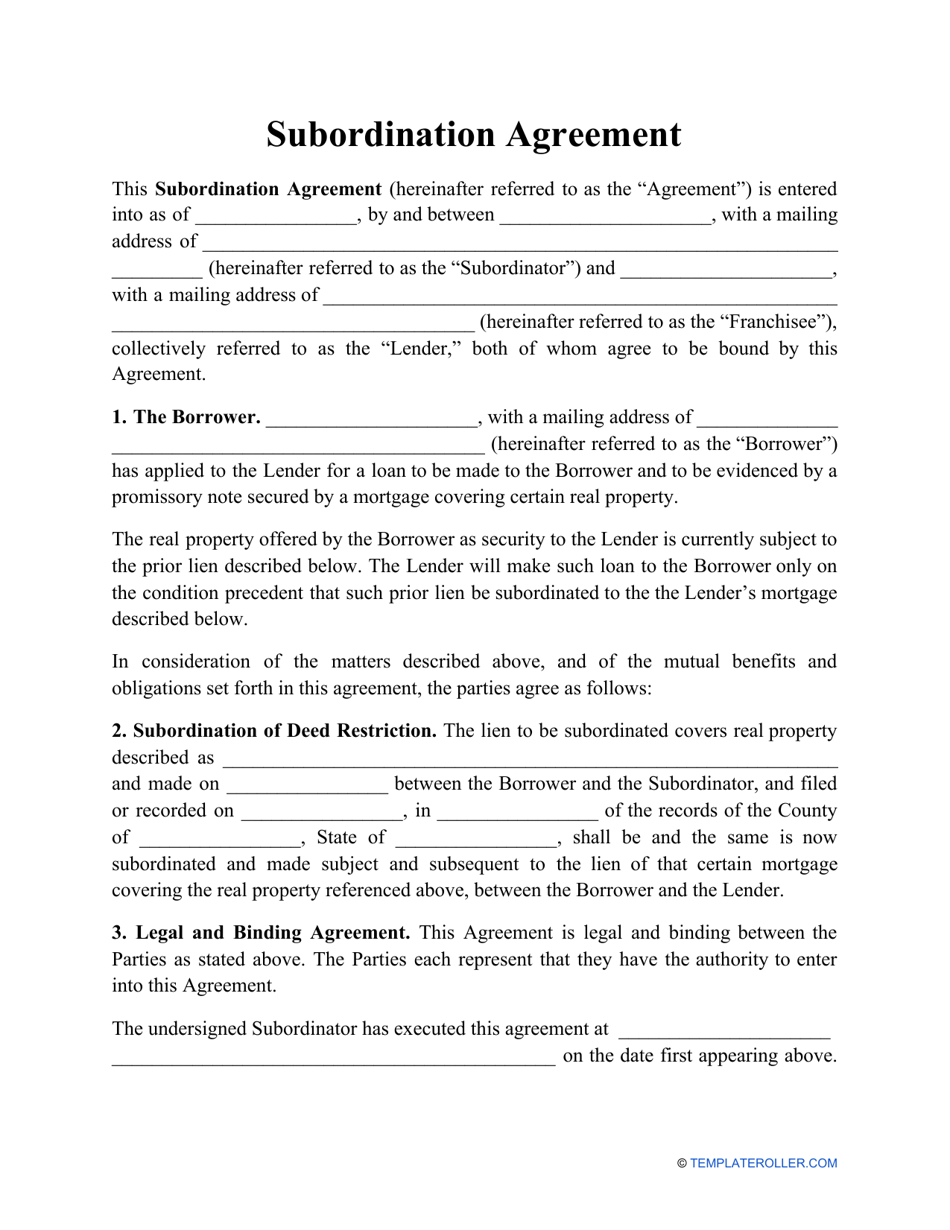

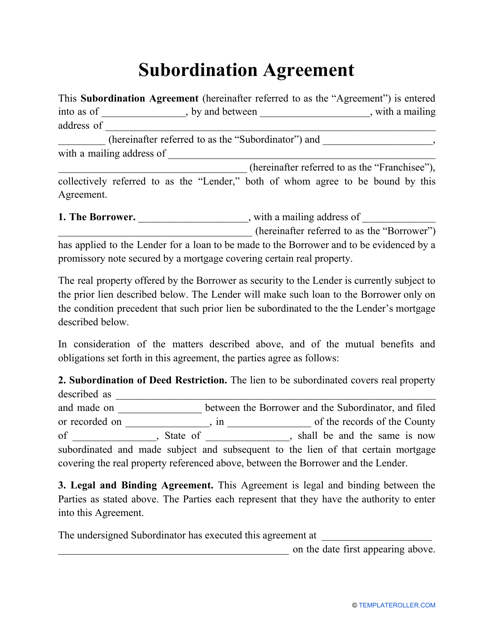

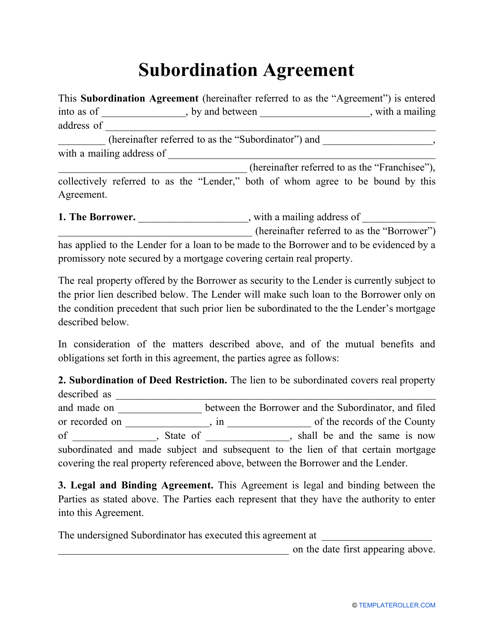

A Subordination Agreement is a formal document signed by a lender and a debtor by means of which the parties confirm the existing debt owed by the borrower has a preference before other debts of the borrower. Often, it is necessary to establish the priority of debts, especially if the debtor regularly fails to make payments, faces insolvency, or the creditor requires immediate payments in accordance with the original contract with the breaching party.

- Loan Subordination Agreement;

- Debt Subordination Agreement.

You can download a printable Subordination Agreement template through the link below or make your own agreement via our online form builder. Using this agreement, you will be able to acknowledge that the claim of a particular creditor is superior to other claims and requests and make the lender whose details are indicated in the contract the primary lender.

ADVERTISEMENT

How to Write a Subordination Agreement?

Follow these steps to prepare a Subordination Agreement:

- Title the document properly . You may draft a Loan Subordination Agreement if you are taking out a second mortgage for your residence and the lender wants to make sure you understand your responsibility before them. Alternatively, name your contract a Debt Subordination Agreement if you owe money to a credit company to show the lender they will be compensated first.

- Identify the parties to the contract - the lender and the borrower . You may refer to them by their full names, addresses, and other personal details if necessary. Here is where you may enter the contact information as well.

- Describe the debt or loan in question . It is highly recommended to refer to the original agreement signed by the parties, especially if the parties negotiated the possibility to handle the debt using subordination. Note that you should keep these documents together to avoid confusion.

- Confirm that the debt described above will be considered prior and superior to all other financial liabilities of the debtor - it becomes the senior debt . This way, other debts of the borrower become junior debts and there is a possibility they will not be repaid in full or there will no be satisfaction for the lender at all, which happens often if the debtor becomes bankrupt after the primary lender's interests are addressed. Here is how it works: if you have $500,000 in assets, while your senior debt is $400,000 and junior debt is $200,000, the primary debtholder will receive the entire amount of debt and other lenders will get the rest of the money - $100,000 in this case - distributed among them.

- Discuss the possible termination of the agreement . It is very likely that the insolvency proceedings lead nowhere or the debtor acquires enough funds to deal with all their debts without supplemental arrangements. Also, the lender may not receive the promised money on time, which gives them the right to cancel the existing contract and seek compensation via other legal methods.

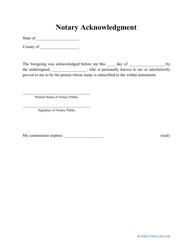

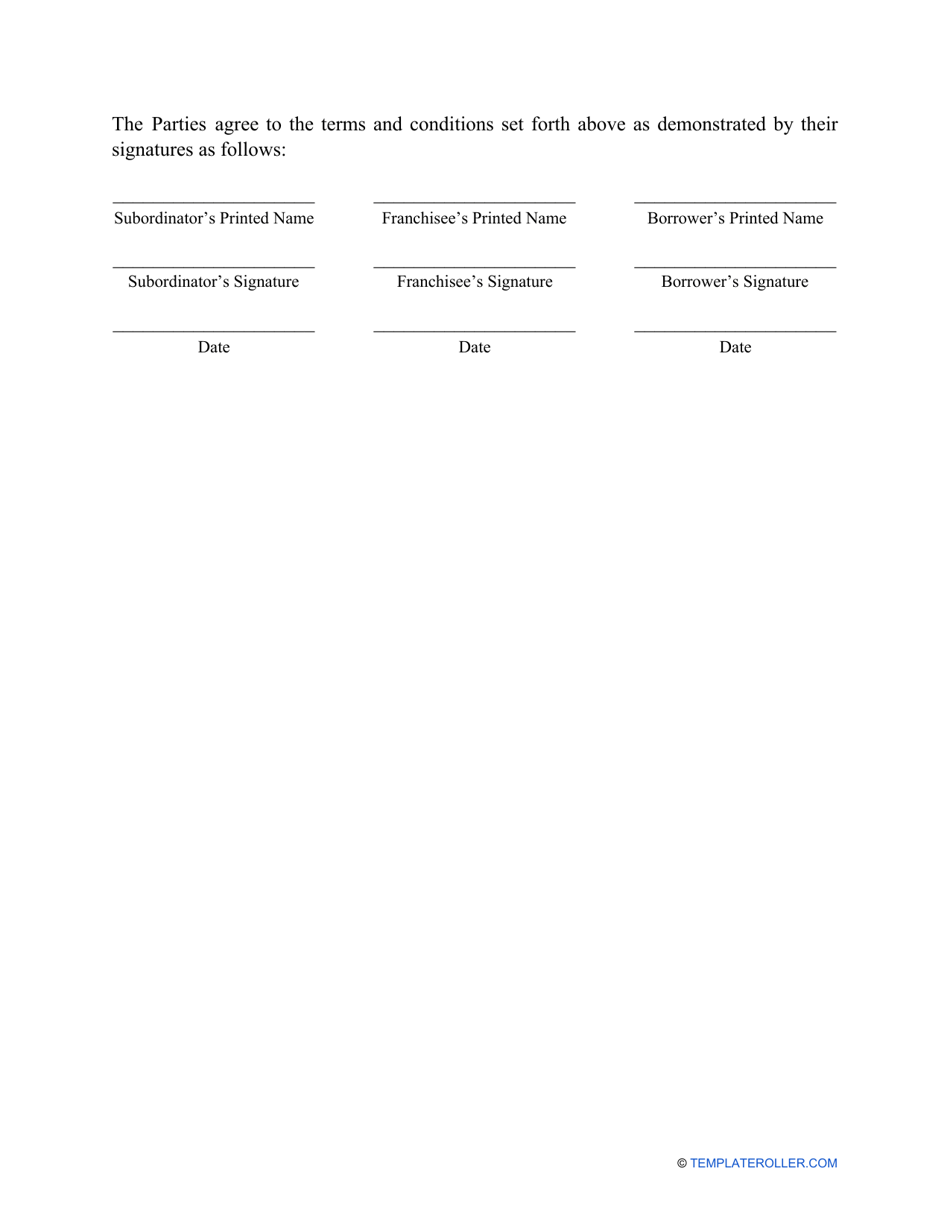

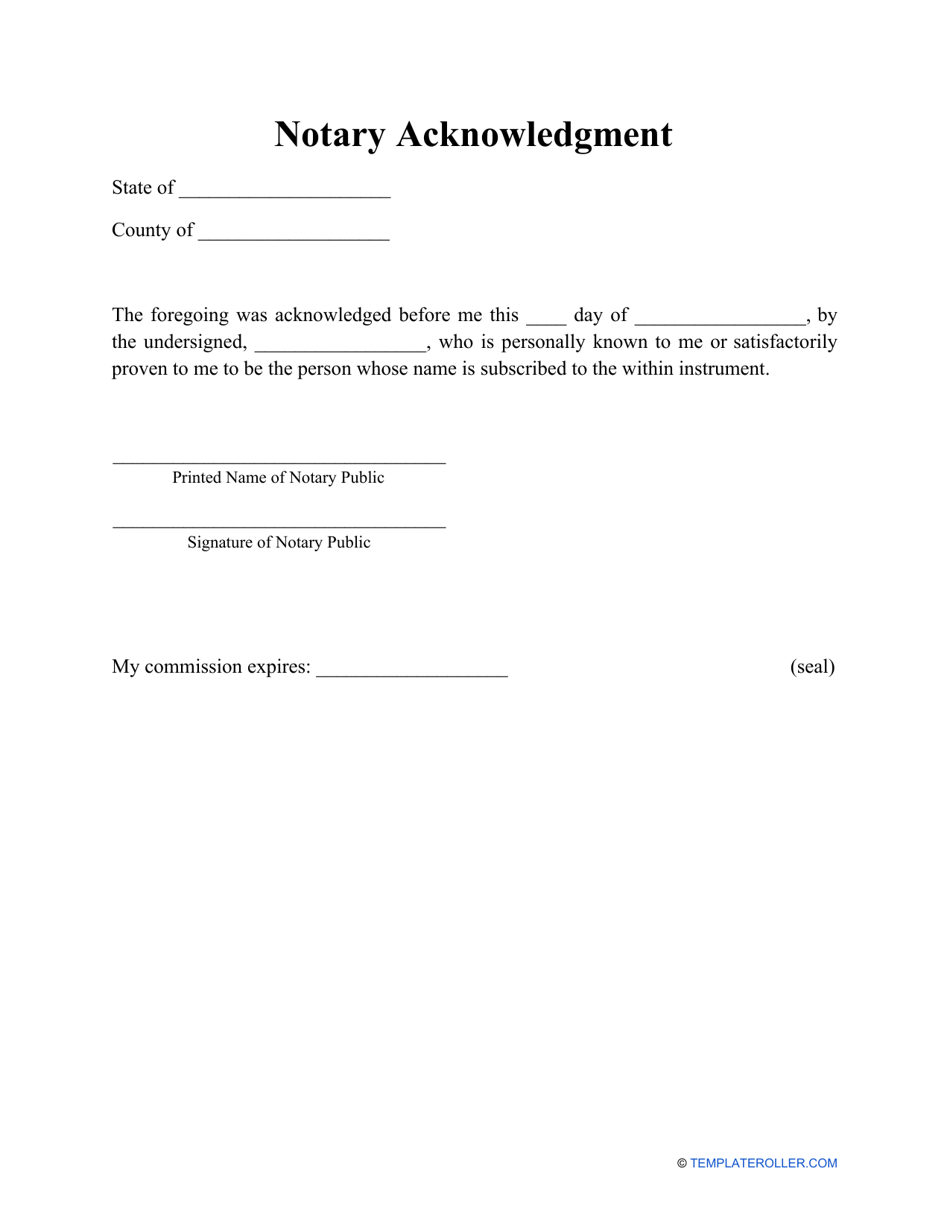

- Sign and date the document . Since your arrangement may involve large sums of money, it is a good idea to complete the deal in the presence of witnesses or a notary public.

Take a look at these related templates:

- Credit Dispute Letter;

- Financial Statement;

- Revolving Credit Agreement.

Download Subordination Agreement Template

4.2 of 5 ( 6 votes )

1

2

3

Prev 1 2 3 Next

ADVERTISEMENT

Linked Topics

Subordination Agreement Real Estate Agreement Loans and Credit Loan Agreement Form Legal Agreement Template Business

Related Documents

- Revolving Credit Agreement Template

- Credit Dispute Letter Template

- Financial Statement Template

- Mortgage Lien Release Form

- Debt Dispute Letter Template

- Iou Template

- Debt Settlement Offer Letter Template

- Mortgage Commitment Letter Template

- Debt Snowball Form

- Debt Collection Report Template

- Business Debt Schedule Template

- Sample Credit Card Debt Settlement Letter

- Sample Debt Validation Letter

- Sample Debt Dispute Letter

- Will the Explosion of Student Debt Widen the Retirement Security Gap? - Alicia H. Munnell, Wenliang Hou, and Anthony Webb - Center for Retirement Research

- Sample Debt Collection Letter From Attorney

- Debt Forgiveness Letter Template

- Denied? the Impact of Student Debt on the Ability to Buy a House

- Promise to Pay Letter Template

- Sample Mortgage Loan Officer Interview Questions

- Convert Word to PDF

- Convert Excel to PDF

- Convert PNG to PDF

- Convert GIF to PDF

- Convert TIFF to PDF

- Convert PowerPoint to PDF

- Convert JPG to PDF

- Convert PDF to JPG

- Convert PDF to PNG

- Convert PDF to GIF

- Convert PDF to TIFF

- Split PDF

- Merge PDF

- Sign PDF

- Compress PDF

- Rearrange PDF Pages

- Make PDF Searchable

- About

- Help

- DMCA

- Privacy Policy

- Terms Of Service

- Contact Us

- All Topics

Legal Disclaimer: The information provided on TemplateRoller.com is for general and educational purposes only and is not a substitute for professional advice. All information is provided in good faith, however, we make no representation or warranty of any kind regarding its accuracy, validity, reliability, or completeness. Consult with the appropriate professionals before taking any legal action. TemplateRoller.com will not be liable for loss or damage of any kind incurred as a result of using the information provided on the site.

TemplateRoller. All rights reserved. 2024 ©

Notice

This website or its third-party tools use cookies, which are necessary to its functioning and required to achieve the purposes illustrated in the cookie policy. If you want to know more or withdraw your consent to all or some of the cookies, please refer to the cookie policy.