This online service allows customers to calculate estimates of various registration and licensing fees.

Fees vary depending on your actual vehicle registration transaction. For example, if the purchase price keyed by the customer differs from what is ultimately entered on the title and submitted to DMV, the vehicle registration fees may change when the vehicle is registered.

Why is the calculator unable to determine fees for my vehicle? plus minusThis system can only determine fees for basic transactions. For transactions that require a more complex calculation of fees (planned non-operation, partial year registration, private school bus, and permanent fleet registration, etc.), you may call DMV at 1-800-777-0133 between 8 a.m. and 5 p.m. Monday through Friday.

No. The fees are based on the purchase price of the vehicle.

Can I pay the vehicle registration fees for my new vehicle directly to DMV? plus minusNormally, the dealer submits the fees to DMV for you.

When will I receive my new license plates after I buy my new vehicle? plus minusUsually within 30-45 days of purchasing your vehicle.

How long is the Purchaser's Temporary Operating Copy valid? plus minusThe permit the dealer provides for display on the passenger side of the front window is valid until the plates and stickers are received by the customer, or for six months from the sale date, whichever comes first.

What are the insurance requirements? plus minusYou must have liability insurance covering damage to the person or property of others. Comprehensive or collision coverage is for damage to your vehicle only, and does not meet the financial responsibility requirement. Check your policy or talk to your agent or broker to be sure that you have the correct liability insurance coverage. The minimum liability insurance coverage required for private passenger vehicles per accident is $35,000 and is defined by the following levels of coverage:

Dealers may charge buyers a document preparation service fee not to exceed $65 (or $80 if a Business Partner Automation (BPA) program participant). This fee is not required or collected by DMV.

The market value of the vehicle is based on the cost price to the purchaser as evidenced by a certificate of cost, bill of sale, titling document, or Kelley Blue Book. The market value includes any trade in or down payment amount but does not include the taxes.

How do I get my vehicle verified? plus minusBring your vehicle to a DMV office for verification of the vehicle’s identification number (VIN). For your convenience, we recommend that you schedule an appointment.

Is there an exemption for military personnel? plus minusMilitary personnel stationed in California are exempt from payment of the vehicle license fee (VLF) on any vehicle owned or leased and registered in California provided:

In order to obtain the VLF exemption, military personnel must complete a Nonresident Military Exemption Statement (REG 5045) form and NATO members are required to complete a North Atlantic Treaty Organization (NATO) Status of Forces Agreement (REG 5046) form.

The duty station must be located in California in order to receive a VLF exemption.

Why are penalties being generated? plus minusNonresident vehicle owners who move to California must register their out-of-state vehicles in California within 20 days of the date they accept employment or establish residency in California. Late registration fees are subject to penalties.

Whom may I contact if I need any additional tax information? plus minusThe Vehicle License Fee (VLF) is the portion of your registration fee that is tax deductible. VLF for Tax Purposes may assist you in determining the VLF paid in a specified tax year.

What is a tax year? plus minusFor the purpose of this transaction, the calendar year 1/1/XX through 12/31/XX is the same as a tax year.

How many tax years may I retrieve information for with this program? plus minusYou may retrieve the current year plus the two prior years. The tax years available are displayed in the tax year drop down box on the VLF for Tax Purposes inquiry screen.

Does the VLF for Tax Purposes transaction identify the name of the person who paid the VLF? plus minus

No. The transaction will display only the VLF paid, based on the information provided.

What is the "DMV Processing Date"? plus minusIt is the date that DMV completed a transaction.

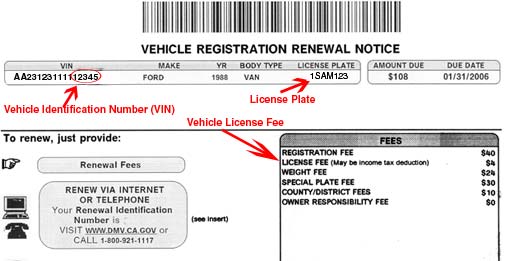

What information do I need to determine the amount of VLF paid for tax purposes? plus minusYou will need the following information:

It is the VLF portion of the fees paid on the processing date listed. Only the VLF paid is deductible for tax purposes.

What is "VLF Refund"? plus minusIt is the prorated amount of the VLF portion of the registration fees, which is refunded when a vehicle is salvaged or is stolen and unrecovered for at least 60 days.

Why did I pay more for my vehicle registration than the VLF for Tax Purposes program displays? plus minus

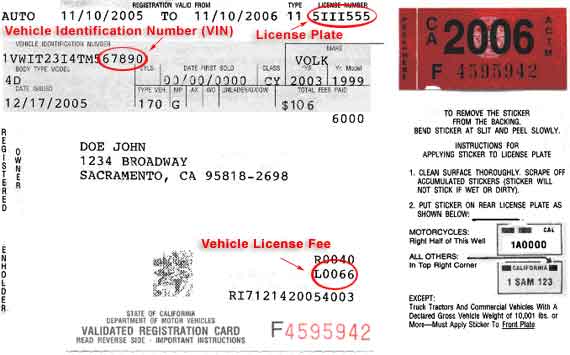

Your annual vehicle registration payment consists of various fees that apply to your vehicle. The Vehicle License Fee is the portion that may be an income tax deduction and is what is displayed. Your renewal notice and registration card itemize these fees in the following categories:

What if my registration fees were paid at the end of a calendar year, but DMV did not process my payment until the beginning of the next calendar year? plus minus

If the VLF paid does not display, select the next tax year. Even though it is displayed in the next year, it is deductible in the year that it was paid.

What if I paid VLF but it does not display? plus minusThere may be some instances where DMV is unable to provide you with VLF payment information. For example:

What if the amount of VLF displayed is more than I paid in the tax year requested? plus minus

What if the amount of VLF displayed is more than I paid in the tax year requested? plus minus

Fees may have been paid over multiple years, but the transaction may not have been completed until the “DMV Processing Date” shown. Please contact your tax consultant (see below).

What if my registration fees were paid with a dishonored check? plus minusUnless the dishonored check has been reimbursed to DMV, the VLF shown cannot be used for tax purposes.

Whom may I contact if I need additional tax information? plus minusNo. Outstanding parking/toll citation fees on the vehicle record at the time the renewal is processed will be charged in addition to the fees displayed on this transaction.

What if I am declaring a higher/lower Commercial Vehicle Registration Act weight? plus minusThe CVRA weight fee is calculated using the weight currently on the vehicle record. If you are declaring a higher/lower CVRA weight, visit Registration Fees to calculate an estimate of the correct CVRA weight fee.

What if I recently moved? plus minusMake sure that you enter your new county and zip code in the Home Address Information so that the fees calculated will be based on those due for your new address.

It is important that you change your address on any other vehicles that you own and for your driver license.

Do the renewal fees displayed include the cost for my personalized Special Interest License Plates? plus minus

Yes. If a Special Interest License Plate is currently assigned to the vehicle, the cost of the plate renewal is included in the displayed fees. However, if the transaction is a transfer of ownership, the plate fees will not display.

What if I qualify for an exemption from registration fees and want to use the exemption on a newly acquired vehicle? plus minus

This transaction generates all registration fees due; use tax is all that will be due if you qualify for an exemption from registration fees.

What if I qualify for a Vehicle License Fee (VLF) exemption? plus minusYou may deduct the VLF from the total fees due on or after your transfer date, for an estimate of fees that will be due.

What if I did not acquire the vehicle from the registered owner listed on the front of the title? plus minus

This transaction only calculates the fee for one transfer. For an estimate of the fees due, add one transfer fee for each buyer in between you and the registered owner listed on the front of the title.

Is use tax due if I purchased my vehicle from a licensed California dealer? plus minusYes. The use tax is paid to the dealer at the time of purchase.

What if a Special Interest License Plate was on my vehicle when I acquired it? plus minusThis transaction will calculate the fees to provide you with a regular license plate.

What if my declared weight is different from that shown on the previous owner's registration card? plus minus

The weight fee is calculated using the weight currently on the vehicle record. If you are declaring a higher/lower weight, use the weight chart to help you calculate the correct weight fee.

What if I want to add or retain planned non-operation status on this vehicle? plus minusThis transaction only calculates full year registration fees. The Fast Facts brochure Reporting Vehicle Status (Registered vs. Non-Operational) provides information and instructions for adding or retaining non-operational status to a vehicle.

Why do I have to pay my renewal fees so early when transferring my vehicle? plus minusThis transaction generates renewal fees 75 days before the expiration date. It is optional to pay them 75 to 31 days prior to the expiration date; however, they must be paid when a transfer is completed within 30 days prior to the expiration date.

Why are multiple year registration fees displaying? plus minusThe vehicle registration has expired and this transaction displays all fees and penalties due.